Samaritan Health Ministries and Health Care Sharing Plans

Overwhelmed by the cost of health insurance? Consider a health care sharing plan. It’s an alternative to costly health insurance and can help you to save hundreds of dollars per month. We save over $1,000 a month with Samaritan Health Ministries.

This post contains affiliate links. Please read my affiliate disclosure.

Are you looking for affordable health insurance? I was in your shoes two years ago. My husband had just left his full-time job, and I was self-employed. Without an employer, we thought our only option was to pay high-cost, high-deductible health insurance plans out of pocket.. For our family of five, we were getting health insurance quotes for $1,500 to $1,800 a month… and that was for a high deductible plan, which meant we’d pay a lot for co-pays and medical costs (usually $5,000 or so on our own) until our insurance kicked in.

So naturally, I started looking for other options. I asked friends on Facebook for advice and something kept coming up: health care sharing, also know as medical sharing plans. I had no idea what that was so I started researching.

And this is the irony… before I started blogging I actually worked in health care for 10 years. I even worked in a health plan for over a year. But I had never heard of the concept of medical sharing plans.

What is a health care sharing plan?

Health care sharing (also known as medical sharing) is a way for people to pay for their health care without health insurance. Within a health care sharing plan, like Samaritan Health Ministries (more on them in a bit), when members have a medical need they get support from other members in the group and pay their health care providers (hospitals, doctors, labs, etc.) directly rather than pay to a health insurance company. And yes it is legal under the Affordable Care Act.

Think of it like this… with traditional health insurance you pay a monthly premium, and when you need medical treatment like an urgent care visit, broken arm, etc. you then go to the hospital or doctor and then pay a deductible based on your visit.

Medical sharing plans work very similar. You pay your monthly share, but instead of sending it to the health insurance company you’re sending it directly to a member in the medical sharing plan. This can vary between sharing plans, but that’s how Samaritan Health Ministries works.

I admit, I thought it was a little weird at first to be sending my monthly share ($495 for my family of 5) to a person rather than a company, but after a couple of months I found that I really enjoyed it. Samaritan encourages you to write a note of encouragement to the person receiving the share, and it felt great to be able to directly help a person.

And when my son broke his arm, and we were the recipients of the shares to cover our medical need, I got so many letters of encouragement from others I didn’t know. It was like getting happy mail from a loving community.

Compare that $495 a month with Samaritan to the $1,500 to $1,800 a month we were quoted with traditional health insurance. It’s way cheaper and a great affordable option.

What medical treatments does it cover?

It can vary, but what I’ve seen with the four major medical sharing plans is that preventative care or well-check visits are paid out of pocket by you. But most other medical needs (except those that are pre-existing conditions) are covered, up to $250,000 per medical need. That could be a broken arm, having a baby, cancer, etc.

What if I have a medical need that’s more than $250,000?

There’s an optional catastrophic plan with Samaritan called Save to Share that covers medical needs that are more than $250,000. We pay an extra $6 a month for our family of five. It’s well worth it. Other health care sharing plans have similar catastrophic plans for a nominal fee.

What if you have a pre-existing condition?

It depends. If you haven’t been treated for it for at least 3 years, then it’s likely allowable but check with the medical sharing plan. My husband had autoimmune issues, and had no problem getting into Samaritan since he wasn’t getting treated for it. I’ll cover this in more detail… keep reading.

Examples of treatments covered

Just to give you an idea… here are a couple of medical treatments we needed when we first got Samaritan Health Ministries…

My then 5 year-old son had croup. I took him to urgent care right before they closed. They gave him a treatment to help open the airways, but because they were closing and it was a breathing treatment it was required that the little man ride in an ambulance and get admitted to the local children’s hospital. He was observed for a few hours at the emergency room, and was discharged. He was fine within a couple of days, but you can imagine the medical bills we racked up… urgent care visit, ER visit, ambulance ride, etc. Samaritan paid for all of it. With traditional insurance, we would have paid for a co-pay for the urgent care visit, ER visit, ambulance, etc. but not with Samaritan.

Later that year my then 5 year-old son fell off the monkey bars at school and broke his arm. It lead to two ER visits, weekly and bi-weekly orthopedic visits, x-rays, casts, etc. Samaritan paid for all of it. With traditional insurance, we would have paid for a co-pay for the doctor visits, ER visits, etc. but not with Samaritan.

In both cases, all we had to pay was our monthly share (like our monthly premium), which was $495 for our family of 5.

What isn’t covered?

Well-check visits, annual physicals and preventative care

This is going to vary by medical sharing plan, but with Samaritan well-check visits, annual physicals, and preventive care isn’t covered. Now I’m fine with this and will be doing a follow-up post on another option later. But in a nutshell, this wasn’t a deal-breaker for me. For instance, my kids go to the pediatrician once a year. He charges about $200 cash pay for that visit per child. That’s $600 total for the year. That’s still worth the savings I get by being a member of Samaritan Health Ministries… remember I’m saving $1,000/mo alone based on my monthly share.

Labs tests

These are covered if it’s related to a medical treatment. For instance, my son’s x-rays were covered as part of his treatment for his broken arm. But for preventative or wellness lab tests or blood work, you’ll need to pay out of pocket. Samaritan does have a discounted lab as a partner you can work directly with.

Pre-existing medical conditions

Pre-existing conditions generally aren’t covered. There are some exclusions like if you haven’t been treated for that condition for 3-5 years then you might be fine. Just check with the medical sharing plan. Like I said, my husband was fine to join even with his history of autoimmune issues.

But what if you or someone in your family can’t get off health insurance due to pre-existing medical conditions? Perhaps you keep health insurance for that one person, and consider Samaritan Health Ministries for the other family members. Paying health insurance for one person vs. 5 people would definitely be a better option. This was an option we considered until we found out my husband would be covered.

Dental and vision

This will vary by health sharing plan, but with Samaritan they do not cover routine care like check-ups, x-rays and labs, and everyday dental work (cavities, root canals) or vision (optometric like vision exams, glasses, contacts). Samaritan does cover dental work if teeth are broken, or vision if related to diseases or injury (cataracts). They also do cover vision therapy if medically necessary.

Samaritan does allow members to submit medical needs that aren’t covered by them to the network of Samaritan members to help cover the share. Members then have the option to help other members who have medical needs but aren’t covered. This is a nice benefit to Samaritan.

We ended up getting dental insurance separately because four of us needed orthodontic work and we visit the dentist every four months for check-ups. Traditional health insurance typically doesn’t cover dental anyway, so we were expecting this cost to fall on us.

Are you required to be religious?

Many medical sharing plans (like Samaritan, Christian Health Ministries and Medi-Share) are religious-based so they usually require you to be a Christian and attend church regularly. Samaritan actually does require that a church vouch for you as part of their admission process.

There are some alternative medical sharing plans that are not religious-based, like Liberty HealthShare or Sedera.

I initially looked at Samaritan, CHS, Medi-Share and Liberty, and those were my top four choices. Keep reading to find out why I chose Samaritan. I don’t have personal experience with the other plans but wanted to give you options if Samaritan is not an option for you. Please do your own research.

In addition, many medical sharing plans don’t cover medical issues that don’t abide by their values, such as illegal drugs, excessive drinking, etc. That means you can, of course, get medical treatment for those things (hospitals cannot deny service), but you would be responsible for those medical bills.

Does the medical sharing plan pay the doctors and hospitals directly?

It depends. Some handle the billing and negotiate rates with the medical providers. With Samaritan, you tell the provider (the hospital, lab, doctor) that you’re a cash-pay patient. Sometimes the medical provider will require you to pay a small deposit. For instance, for my son’s ER visit I believe we paid about $85. We saved the receipt and got reimbursed later from Samaritan.

I have a medical need. Now what do I do?

The great thing about medical sharing plans – specifically Samaritan Health Ministries – is that most plans allow you to go to any doctor or hospital. There’s no in-network or out-of-network doctors. Just choose the medical provider you want to see.

At the time of service, tell the medical provider you’re a cash-pay patient. Again, they may require you to pay a deposit before you get discharged. Just save the receipt. When you get the full bill, you can call the billing department and say you are a cash pay patient. You’ll likely get 20-25% off the total price.

Then submit the bills (along with the discounted price) to Samaritan. Their website is really user friendly. Start a medical need and submit the bills. Samaritan will review the information and give a status within 2-3 weeks.

Once the medical need is accepted (sometimes more information is needed from the provider), it takes about 3-4 weeks to start getting checks from other Samaritan members who submit their monthly shares to you – totaling the cost of the medical treatment you submitted. The whole process to submit the paperwork and get the reimbursement was about 4-6 weeks for me. It usually took longer than that to get the bills from the medical providers.

So it was a bit more work for me on my end, but here’s the cost savings (and why medical sharing plans are so worth it):

- Monthly share was $495/mo with Samaritan vs. $1,500/mo with traditional health insurance

- $0 paid on doctor visits, labs, ER, urgent care, etc. for medical treatment with Samaritan vs. $100-$1,000/visit for co-pays and deductibles that I would definitely be paying with traditional health insurance

- 25% discount on medical treatment as a cash-pay patient – which helped Samaritan more than me but just shows how

In the end, it was so worth it to me to save $1,000/mo on monthly shares and save per medical treatment. The little bit of paperwork on my end wasn’t that big of deal. I just had to be organized with the bills and diligent in calling the billing department for each medical provider.

And the cost saving is worth it even though I get a weird look when I tell the hospital or doctor’s office that we’re cash pay. Yes, it happens all the time. Just remember the cost savings is SO WORTH IT.

Why I chose Samaritan Health Ministries

There were a few reasons why I chose Samaritan Health Ministries over other health care sharing plans:

1. Long History

Samaritan Health Ministries has been around for over 20 years. That was a huge factor for me. I wanted to be with a medical sharing plan that’s been around a long time with a lot of happy members. In fact, they have over 250,000 members.

2. Positive Reviews

Most of the people I knew who were on a health care sharing plan were with Samaritan Health Ministries. When I asked for recommendations, my inbox was flooded with positive reviews from people who’ve been with Samaritan for 5, 10, 20 years. I had a friend who had her own kids on Samaritan and now her grandkids were on it too.

Like I said, I was down to four health sharing plans, and Samaritan came out on top for me based on reviews from others, their own reputation and my own experience talking to them when I was doing my research.

3. Alternative and Holistic Care

Samaritan Health Ministries is one of the only medical sharing plans that covers alternative and holistic health treatments – such as biofeedback, chiropractic care, massage therapy, and naturopathic care if prescribed by a doctor as medically necessary. This was one of the deal-breakers for me as my family requires a lot of alternative and holistic care, and I wanted to have a medical sharing plan that would cover the medical costs.

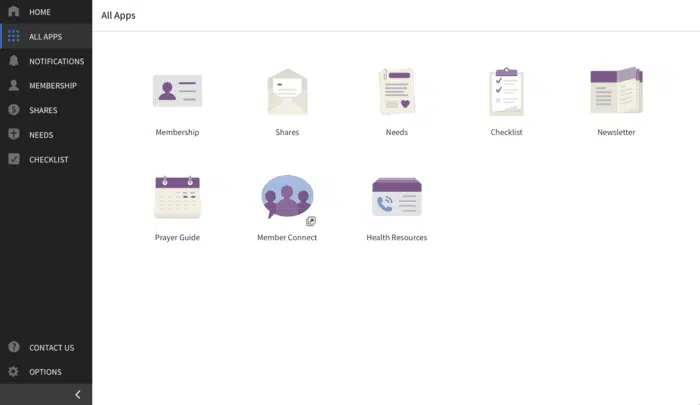

4. Ease of Use

Now this wasn’t something I knew before we actually needed medical treatments, but the Samaritan member website is fantastic. It’s so easy to submit medical needs, see the progress of those needs and getting payment, etc. At any time, I could log-in to see the status of our medical needs.

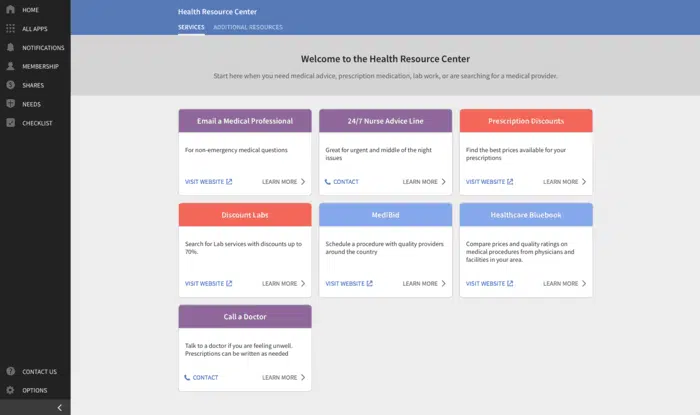

5. Online Resources

As I mentioned, the Samaritan member website is amazing and so easy to use. But there’s also a ton of great (and many free) resources for members, like prescription drug discounts, lab discounts, 24/7 nurse line, email a medical professional, call a doctor, healthcare blue book and more for Samaritan members. It’s like having all the bells and whistles of traditional health insurance.

6. People Helping People

This was initially not a factor for me, but once I started sending my monthly shares to people who had medical needs I realized just how important it was that Samaritan set up their medical sharing model this way. With traditional health insurance, it’s easy to not see people. You’re dealing with a corporation. But with Samaritan, you’re sending notes of encouragement and prayers to real people. And when you have a medical need (like we did) those notes really did make all the difference.

I feel good about supporting a company that facilitates people helping people. And there are opportunities to help members who have medical needs that aren’t covered by Samaritan. We usually donate monthly to help others with medical needs outside of our monthly obligation.

7. Responsive and Knowledgeable Staff

I was down to four medical sharing plans when I initially did my research, and the final decision came to this point… responsiveness and knowledge. I had asked Samaritan about my husband’s pre-existing medical condition and whether we were eligible based on his history. Samaritan got back to me within a day and answered my question very thoroughly. When I did the same with the two other medical sharing plans, the response time was delayed and the responses weren’t clear. That was a huge factor for me. If they couldn’t answer a simple question in a timely manner, how would they handle my medical needs.

So Samaritan came out on top, and that’s who we went with. It’s been nearly two years since we made the decision, and I couldn’t be happier. I would choose them again in a heartbeat.

How to sign up with Samaritan Health Ministries?

Head over to Samaritan Health Ministries to get more information to see if it’s right for you and your family. They have a lot of great information on what their health sharing plan covers and how to get signed up.

When you do sign up, let them know that I (Tracey Black aka Don’t Mess with Mama) sent you.

Summary

As someone who used to work in health care, I admit it was a hard transition for me mentally to let go of the idea of health insurance. That’s all I’ve ever known. But as someone who’s self-employed and responsible for my own health care coverage, I knew a health care sharing plan was the right thing for our family.

In our first six months, we had two medical needs with my youngest son that really put Samaritan Health Ministries to the test, and I was so pleased with the experience and in the end the cost savings. We can reinvest that money into our health – like organic food, supplements, non-toxic household products, etc. vs. living paycheck to paycheck just to pay the monthly premiums like we would with traditional health insurance.

Whether you’re self-employed, a business owner, or someone looking for more affordable options to traditional health insurance, I highly recommend Samaritan Health Ministries.

Are you in a medical sharing or health sharing plan? What’s been your experience?

Does Samaritans cover childhood immunizations?

No, routine medical care like physicals, checkups, vaccinations are not eligible. But I find these costs to be pretty nominal and factored into the savings over traditional health insurance, it’s still a great deal.

Was your husband able to get treatment for his autoimmune issues treated and covered?

Great question. By the time we got on Samaritan, we had already resolved many of them through diet and lifestyle. If you have a new medical need it should be covered.

How difficult is it to have a MD refer the family to receive chiropractic care? We (family of 5) prefer the holistic/naturopathic approach to medicine. Wondering if SHM is the right choice for us? Thanks for any feedback.

I would reach to Samaritan. We did have chiropractic care covered because there was a new medical need that my chiropractor discovered.